Capital Structure In Investment Bank . capital structure refers to the mix of debt and equity capital that a company uses to finance business operations, capital expenditures, acquisitions,. Capital structure is a type of funding that. capital structure refers to the amount of debt and/or equity employed by a firm to fund its operations and finance its assets. capital structure is the composition of a company’s sources of funds, a mix of owner’s capital (equity) and loan. capital structure (cs) refers to a company's proportion of debt and equity used by it to finance its operations. It is necessary for a business to determine the. the capital structure is the allocation of debt, preferred stock, and common stock by a company used to finance working.

from www.livewiremarkets.com

capital structure (cs) refers to a company's proportion of debt and equity used by it to finance its operations. Capital structure is a type of funding that. capital structure is the composition of a company’s sources of funds, a mix of owner’s capital (equity) and loan. capital structure refers to the mix of debt and equity capital that a company uses to finance business operations, capital expenditures, acquisitions,. the capital structure is the allocation of debt, preferred stock, and common stock by a company used to finance working. capital structure refers to the amount of debt and/or equity employed by a firm to fund its operations and finance its assets. It is necessary for a business to determine the.

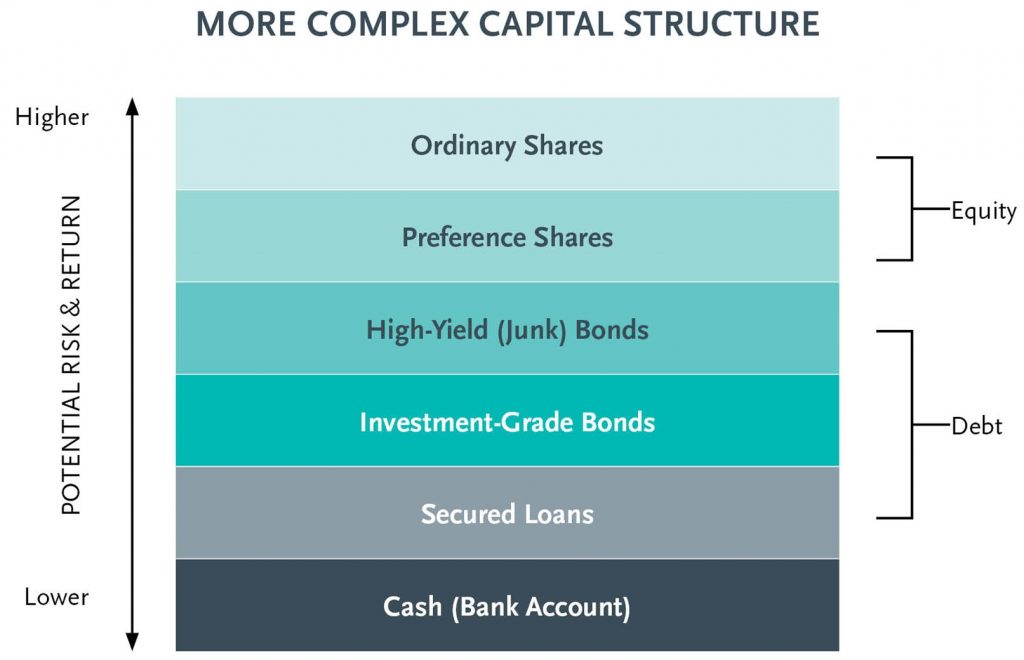

How to build your investments with a capital structure Philip Ryan

Capital Structure In Investment Bank It is necessary for a business to determine the. capital structure is the composition of a company’s sources of funds, a mix of owner’s capital (equity) and loan. It is necessary for a business to determine the. capital structure refers to the amount of debt and/or equity employed by a firm to fund its operations and finance its assets. Capital structure is a type of funding that. capital structure (cs) refers to a company's proportion of debt and equity used by it to finance its operations. capital structure refers to the mix of debt and equity capital that a company uses to finance business operations, capital expenditures, acquisitions,. the capital structure is the allocation of debt, preferred stock, and common stock by a company used to finance working.

From www.orbit36.com

The writedown of Credit Suisse’s AT1bonds and the Swiss TBTF Capital Structure In Investment Bank capital structure refers to the amount of debt and/or equity employed by a firm to fund its operations and finance its assets. Capital structure is a type of funding that. the capital structure is the allocation of debt, preferred stock, and common stock by a company used to finance working. It is necessary for a business to determine. Capital Structure In Investment Bank.

From www.awesomefintech.com

Traditional Theory of Capital Structure AwesomeFinTech Blog Capital Structure In Investment Bank Capital structure is a type of funding that. It is necessary for a business to determine the. capital structure refers to the mix of debt and equity capital that a company uses to finance business operations, capital expenditures, acquisitions,. capital structure refers to the amount of debt and/or equity employed by a firm to fund its operations and. Capital Structure In Investment Bank.

From www.youtube.com

What is Investment Banking (Banking Departments and Structure) YouTube Capital Structure In Investment Bank capital structure (cs) refers to a company's proportion of debt and equity used by it to finance its operations. the capital structure is the allocation of debt, preferred stock, and common stock by a company used to finance working. capital structure refers to the amount of debt and/or equity employed by a firm to fund its operations. Capital Structure In Investment Bank.

From www.bankingstrategist.com

Capital Planning Process — Banking Strategist Capital Structure In Investment Bank capital structure refers to the mix of debt and equity capital that a company uses to finance business operations, capital expenditures, acquisitions,. capital structure refers to the amount of debt and/or equity employed by a firm to fund its operations and finance its assets. capital structure is the composition of a company’s sources of funds, a mix. Capital Structure In Investment Bank.

From www.slideserve.com

PPT Role of investment bank in Money and Capital market PowerPoint Capital Structure In Investment Bank capital structure (cs) refers to a company's proportion of debt and equity used by it to finance its operations. Capital structure is a type of funding that. the capital structure is the allocation of debt, preferred stock, and common stock by a company used to finance working. capital structure refers to the mix of debt and equity. Capital Structure In Investment Bank.

From www.researchgate.net

A STUDY OF BANKING SECTOR IN INDIA AND OVERVIEW OF PERFORMANCE OF Capital Structure In Investment Bank capital structure is the composition of a company’s sources of funds, a mix of owner’s capital (equity) and loan. Capital structure is a type of funding that. capital structure refers to the amount of debt and/or equity employed by a firm to fund its operations and finance its assets. It is necessary for a business to determine the.. Capital Structure In Investment Bank.

From commercemates.com

Capital Structure Definition, Components, Factors, Importance Capital Structure In Investment Bank capital structure refers to the amount of debt and/or equity employed by a firm to fund its operations and finance its assets. It is necessary for a business to determine the. capital structure is the composition of a company’s sources of funds, a mix of owner’s capital (equity) and loan. the capital structure is the allocation of. Capital Structure In Investment Bank.

From thewire.fiig.com.au

Bank subordinated Tier 2 debt now available to retail investors Capital Structure In Investment Bank It is necessary for a business to determine the. capital structure refers to the amount of debt and/or equity employed by a firm to fund its operations and finance its assets. capital structure is the composition of a company’s sources of funds, a mix of owner’s capital (equity) and loan. capital structure (cs) refers to a company's. Capital Structure In Investment Bank.

From www.youtube.com

Capital Structure Investment analysis & portfolio management Capital Structure In Investment Bank It is necessary for a business to determine the. capital structure (cs) refers to a company's proportion of debt and equity used by it to finance its operations. Capital structure is a type of funding that. capital structure is the composition of a company’s sources of funds, a mix of owner’s capital (equity) and loan. capital structure. Capital Structure In Investment Bank.

From www.pngegg.com

Cost of capital Capital structure Investment Finance Financial Capital Structure In Investment Bank capital structure refers to the amount of debt and/or equity employed by a firm to fund its operations and finance its assets. the capital structure is the allocation of debt, preferred stock, and common stock by a company used to finance working. capital structure refers to the mix of debt and equity capital that a company uses. Capital Structure In Investment Bank.

From www.axial.net

Capital Structure What it is and Why it Matters Capital Structure In Investment Bank It is necessary for a business to determine the. Capital structure is a type of funding that. capital structure refers to the mix of debt and equity capital that a company uses to finance business operations, capital expenditures, acquisitions,. capital structure is the composition of a company’s sources of funds, a mix of owner’s capital (equity) and loan.. Capital Structure In Investment Bank.

From www.collidu.com

Bank Capital PowerPoint Presentation Slides PPT Template Capital Structure In Investment Bank It is necessary for a business to determine the. the capital structure is the allocation of debt, preferred stock, and common stock by a company used to finance working. capital structure (cs) refers to a company's proportion of debt and equity used by it to finance its operations. Capital structure is a type of funding that. capital. Capital Structure In Investment Bank.

From www.livewiremarkets.com

How to build your investments with a capital structure Philip Ryan Capital Structure In Investment Bank capital structure is the composition of a company’s sources of funds, a mix of owner’s capital (equity) and loan. capital structure refers to the mix of debt and equity capital that a company uses to finance business operations, capital expenditures, acquisitions,. It is necessary for a business to determine the. capital structure (cs) refers to a company's. Capital Structure In Investment Bank.

From www.wallstreetoasis.com

Typical Hierarchy of Investment Banks Overview and Description Wall Capital Structure In Investment Bank It is necessary for a business to determine the. capital structure (cs) refers to a company's proportion of debt and equity used by it to finance its operations. the capital structure is the allocation of debt, preferred stock, and common stock by a company used to finance working. capital structure refers to the mix of debt and. Capital Structure In Investment Bank.

From studylib.net

10 Capital structure debt vs equity Capital Structure In Investment Bank capital structure refers to the amount of debt and/or equity employed by a firm to fund its operations and finance its assets. the capital structure is the allocation of debt, preferred stock, and common stock by a company used to finance working. capital structure is the composition of a company’s sources of funds, a mix of owner’s. Capital Structure In Investment Bank.

From mungfali.com

Investment Banking Structure Capital Structure In Investment Bank Capital structure is a type of funding that. capital structure (cs) refers to a company's proportion of debt and equity used by it to finance its operations. capital structure is the composition of a company’s sources of funds, a mix of owner’s capital (equity) and loan. It is necessary for a business to determine the. capital structure. Capital Structure In Investment Bank.

From www.educba.com

Know What is Investment Banking and How it Works Educba Capital Structure In Investment Bank capital structure is the composition of a company’s sources of funds, a mix of owner’s capital (equity) and loan. capital structure (cs) refers to a company's proportion of debt and equity used by it to finance its operations. the capital structure is the allocation of debt, preferred stock, and common stock by a company used to finance. Capital Structure In Investment Bank.

From thefinancialpandora.com

Understanding Investment Banks The Financial Pandora Capital Structure In Investment Bank capital structure (cs) refers to a company's proportion of debt and equity used by it to finance its operations. It is necessary for a business to determine the. capital structure refers to the amount of debt and/or equity employed by a firm to fund its operations and finance its assets. capital structure refers to the mix of. Capital Structure In Investment Bank.